When I was a youngster, it was fashionable in my set of friends to be broke before the end of the month. Then like a true group, we’d pool in our resources and plan outings with minimal cost while waiting for our parents to shell out the next month’s pocket money.

It’s not unusual to look back at our carefree childhood days and remember the safety net that our parents provided.

What we often forget is the money management lessons that they might have imparted too. Including the scolding that preceded the negotiations and bargaining when one asked for extra dole outs.

My parents allowed me to ‘earn’ the extra cash by reading books from their amazing collection and providing them with book reviews. That led to developing a lifelong love for books and I can’t imagine my life without my literary companions.

I’ve recounted the story in my blog post Negotiate to Win. It is also a tribute to my late father who not only awoke a love for literature in me but made me understand the value of work as I earned my way to my first cassette recorder.

It was also a lesson in financial literacy for me!

As an adult, I often wish I could do similar negotiations and tap into abundance. The truth is that one has to learn money management skills. I learned the income and saving part as a child.

The expense side and figuring out how to balance a budget came soon enough when I entered the workforce.

One thing that I did learn early on is that how much we make is not as important as what we do with what we’ve got. In other words, getting the most out of our money is the key to proper money management.

When I originally wrote this blog post in April 2016, my intention was to celebrate Financial Literacy Month focusing on areas of money and finance awareness through a blog series.

The objective of this blog series is to help you, no matter your stage of life, to start working towards achieving your financial goals.

Some of your goals might require a certified money manager or an investment adviser to guide you. Those professionals will have a longer-term view of your finances and the big picture. Such decisions are outside the scope of this post.

I have since published a Kindle book Money Success Secrets: Alchemy of Mindset and Management. This explores how to befriend the money resources that we have and make them work better for us.

In this post, we’ll look at your current stage of financial management skills. The aim is to get you thinking about areas where you can help yourself manage your wallet.

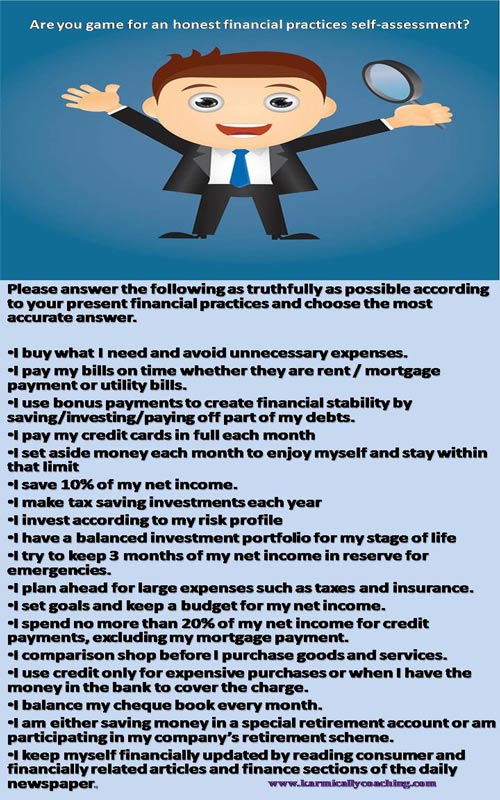

Are you game for an honest financial practices self-assessment?

Everyone loves a good quiz and self-assessment. Let’s look at your financial practices.

Financial Literacy Self-Assessment

Total your score: 0 points for each never; 1 point for each sometimes; 2 points for each always

How did your Money Management Score Go?

26 – 36 points suggests you are practicing good money management skills.

15 – 25 points suggests that you are doing well in some aspects of money management but can improve your money management skills – my book will help.

0 – 14 points suggests that you need to improve your money management skills – you definitely want to read my book!

So how did it go? Did you learn something new about yourself? Anything that you feel you can change this week? Do share in the comments box below!

I adhere to the Certified Coaches Alliance Code of Ethics and Standards. A copy is available on request.

I adhere to the Certified Coaches Alliance Code of Ethics and Standards. A copy is available on request.

Let's Talk through the Connect Form:

Let's Talk through the Connect Form: