This post has already been read 3898 times!

When I was a youngster, it was fashionable in my set of friends to be broke before the end of the month. Then like a true group, we’d pool in our resources and plan outings with minimal cost while waiting for our parents to shell out the next month’s pocket money.

It’s not unusual to look back at our carefree childhood days and remember the safety net that our parents provided.

What we often forget is the money management lessons that they might have imparted too. Including the scolding that preceded the negotiations and bargaining when one asked for extra dole outs.

My parents allowed me to ‘earn’ the extra cash by reading books from their amazing collection and providing them with book reviews. That led to developing a lifelong love for books and I can’t imagine my life without my literary companions.

I’ve recounted the story in my blog post Negotiate to Win. It is also a tribute to my late father who not only awoke a love for literature in me but made me understand the value of work as I earned my way to my first cassette recorder.

It was also a lesson in financial literacy for me!

As an adult, I often wish I could do similar negotiations and tap into abundance. The truth is that one has to learn money management skills. I learned the income and saving part as a child.

The expense side and figuring out how to balance a budget came soon enough when I entered the workforce.

One thing that I did learn early on is that how much we make is not as important as what we do with what we’ve got. In other words, getting the most out of our money is the key to proper money management.

When I originally wrote this blog post in April 2016, my intention was to celebrate Financial Literacy Month focusing on areas of money and finance awareness through a blog series.

The objective of this blog series is to help you, no matter your stage of life, to start working towards achieving your financial goals.

Some of your goals might require a certified money manager or an investment adviser to guide you. Those professionals will have a longer-term view of your finances and the big picture. Such decisions are outside the scope of this post.

I have since published a Kindle book Money Success Secrets: Alchemy of Mindset and Management. This explores how to befriend the money resources that we have and make them work better for us.

In this post, we’ll look at your current stage of financial management skills. The aim is to get you thinking about areas where you can help yourself manage your wallet.

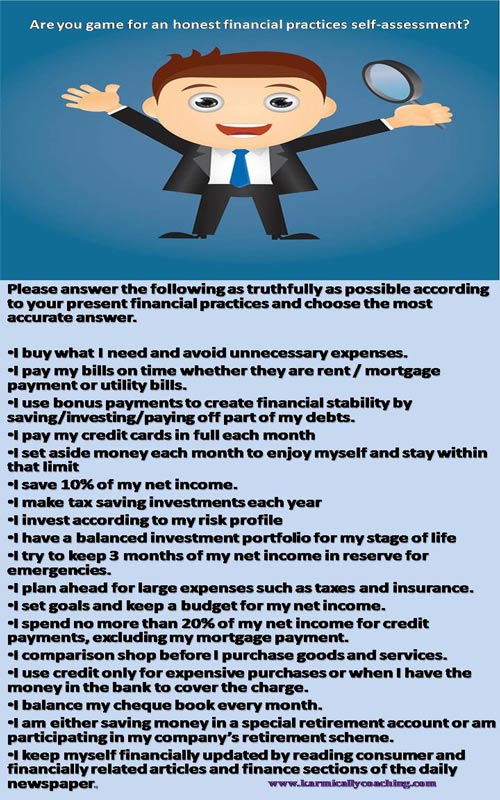

Are you game for an honest financial practices self-assessment?

Everyone loves a good quiz and self-assessment. Let’s look at your financial practices.

Financial Literacy Self-Assessment

Total your score: 0 points for each never; 1 point for each sometimes; 2 points for each always

How did your Money Management Score Go?

26 – 36 points suggests you are practicing good money management skills.

15 – 25 points suggests that you are doing well in some aspects of money management but can improve your money management skills – my book will help.

0 – 14 points suggests that you need to improve your money management skills – you definitely want to read my book!

So how did it go? Did you learn something new about yourself? Anything that you feel you can change this week? Do share in the comments box below!

I adhere to the Certified Coaches Alliance Code of Ethics and Standards. A copy is available on request.

I adhere to the Certified Coaches Alliance Code of Ethics and Standards. A copy is available on request.

Let's Talk through the Connect Form:

Let's Talk through the Connect Form:

This is such a great topic to touch upon Vatsala. And a needed one. Mpst of us have struggled with managing finances. Yes I wished I was wiser when I was younger…but well, we live and learn. I found myself nodding through all those introspective financial questions you have listed…haven’t checked my score yet though 😉

I’m sure you’ll get an awesomely high score, Zeenat. We learn from experience, especially when we see the interest rate charges on our credit cards!

Amazing came here after doing my daily money tracking

Looking forward to checking out your book

This is something i was do good at then one situation turned out financial state upside down and now turning it around

You will definitely resonate with the guidance in the book, Suzie. We often get out of sync with our financial management but this too passes once we take action to get back on track.

Since I downsized my living space and my work space, I’ve also been able to downsize my financial life as well. There’s a big difference between needs and wants. I try not to deprive myself but, rather, to find ways to bring joy into my life that doesn’t cost anything. P.s. I love the idea of your parents having you read and do a book report to earn money. I might just try it with my grandkids!

I learned to downsize when I faced redundancy in a recessionary economy and had a mortgage to service, Barb. I was always good at managing my money so I wasn’t too worried about the loan repayments but downsizing helped me understand the difference between needs and wants. Even now, I first focus on my need and then treat myself to a want which funnily enough is usually splurging on books!

You must try the book report tactic my parents used. It does work.

Thank you for this insightful post Vatsala. I’m excited to go to Amazon and order your book. Your wisdom is always appreciated. <3

Thank you Debra. I appreciate you!

Very timely! Thank you for a non-intimidating financial/ personal growth post. I thought your quiz was very good and helpful.

Welcome to The Karmic Ally Coaching Experience Blog, Denise. I’m glad you found the quiz helpful. At my blog, I try to keep things non-intimidating. 🙂 The idea of creating pain for the reader and then jumping in with a Super Hero solution isn’t my style. 🙂

I love that your parents paid you to read books and report on them! I may try that around here, although my son already loves to read…

I definitely have some things I can improve on! I, too, wish money weren’t a human issue! Since it still seems to be, it’s wonderful you are doing this!

I sometimes think my parents used it as a double ploy to make sure we children watched less television and discover the world of literature while ‘earning’ our extra pocket money, Kimberly. 😉

Money is an energy and currency to help us get what we really need but in today’s world, it seems to be an end in itself. Managing what we have and appreciating the true abundance of life makes the going easier.

I am at a place in my life where money is not an issue. If we had more we would use it to help family more. It was not always the case & in my first marriage we had a fluctuating cash business & I did not know how to manage that.

Often we think if I only have more income, then, but that is not the case. It really is about how you manage what you have. I had to learn this & got a good score on this test.

With experience we learn to manage our money better Roslyn. I read a long time back that having more money would not help in saving because our expenses would rise to ‘fill the gap’ or rather we would spend more based on our purchasing power and this was visible in 2008 when a lot of otherwise high earning professionals faced their own financial crisis with debts that had to be serviced and low savings. I’m not surprised you got a good score!

Lovely post, Vatsala. I really appreciate your statement: “how much money we make is not as important as what we do with what we’ve got.” There is a drive on the internet these days to charge exorbitant prices for our services, as if that is how we validate ourselves – and I am having an ‘allergic reaction’ to that mentality, which I think goes hand in hand with our culture’s driving us to achieve outer markers of success – goals that might not even be our own! This is certainly a rich topic (pun intended) to explore and thank you for giving some space to vent about a pet peeve! Blessings, Reba

Welcome to The Karmic Ally Coaching Experience Blog, Reba. I do so agree with you about the internet drive. I would prefer being offered a product or service at a reasonable price point rather than one which makes me close the browser despite all those thousands worth of bonuses which I would never use. I read an article by a respected marketing professional sometime back advising people to stop doing it because the customer was getting wise to it.

I’m happy you felt my blog was a safe place to vent a pet peeve. There are lots of other people who feel the same way.

So much of my early life was focused on money, that I had to really release that issue and not obsess so much about it. I used to carry a little notebook around with me and literally write every penny I spend down in it. I was counting my money at age 5. I got a good score on your quiz and have committed to myself to be smart with money, but not to always focus on it. If I really want something in my life, like doing a workshop or even taking a trip, I now choose it, as a way of choosing myself. My parents always struggled with money and I think a lot of my early concern about money, came from them. It can still be a trigger for me, and I’ve learned it is possibly one of my doubles in my life and has a great ability to teach me about myself and myself in relation to others. Wouldn’t life be grand if money wasn’t our human issue! Thanks for the great post, Vatsala! You can see that money is just one of those issues I’ve arrived here to explore this lifetime it seems.

Our early money memories are based on our observations of how our parents handled it and not many people realize how a cash crunch in childhood affects our own money management style ranging from being miserly to spending lavishly. The right approach is to find a medium path and treat money as a means to an end and not an end in itself. Thanks for sharing your experience with us, Beverley.

I wish I knew you when I was younger and less money wise. I seem to have things worked out pretty well now (I did the test and scored 26) but it sure took me some years and some hardships to get it right. It’s great you are offering free resources, like your teleclass, to help people.

We learn from experience, Tamuria. I wish I had known you too in our younger years! 26 is a good score. One way to improve on it is to see which of the other practices you can start using. It will make your money management even better. April is Financial Literacy Month and the teleclass is my way of trying to help.