This post has already been read 752 times!

The phrase doing a gig has been around since a long time. I was introduced to the term way back in the late 1980’s when studying in London by aspiring musicians or actors within my circle of friends.

It wasn’t uncommon to head to an artist-centric pub with other friends to watch their band play or act in skits. We supported their gigs because we were aware that their income depended on these gigs.

I admire people who are willing to play the role of starving artist with the dream to hit it big time if they hang on long enough and get the right breaks.

It requires a lot of self-motivation and resilience to handle the out of work periods.

The story of Van Gogh apparently doesn’t bother them or if it does, they don’t show it.

My interest was aroused last year when a friend from my LinkedIn network told me about how the gig economy was acquiring new entrants in the pandemic world.

That was the time professionals were reaching out asking for help in getting jobs and even though I’m not in Executive Search, I wanted to give them ideas to apply and this was one worth exploring.

Normally when we talk about gig economy, one thinks about

- Uber/Lyft drivers

- TaskRabbit workers

- Airbnb landlords

- Online marketplace sellers

- Volunteers

- Artists

But the new entrants my friend was telling me about were professionals who were highly skilled and open to contingent work arrangements and included

- Freelancers

- Consultants

- Independent contractors and professionals

- Temps (temporary contract workers)

Professionals who had lost their jobs or were furloughed were entering that segment of the employment market. .

There are industries where doing gigs is normal but here my friend was telling me about other industries where the gig concept was getting embedded.

From what I know, gigs can be risky ventures and one has to have a lot in place if one plans to make a good living from it.

But it’s a good way to test the waters if you’re planning to become a freelancer, have a side hustle or even start a business.

What’s the gig in Gig Economy?

The gig economy gets its name from each piece of work being akin to an individual ‘gig’ – although, such work can fall under multiple names.

The simplest definition I could find is a labour market characterized by the prevalence of short-term contracts or freelance work as opposed to permanent jobs.

It isn’t freelance work as such although both gigs and freelance workers are hired for one-time jobs.

Also, if you ask a freelancer to be honest, they’ll most probably admit they’d prefer a long term contract or continuous project over the one-time freelance gigs or temp assignments.

Gig work can fall under multiple names and according to an article I read, it has been called the “sharing economy” — mostly in reference to platforms such as Airbnb — and the “collaborative economy“.

However, at its core are app-based platforms that dole out work in bits and pieces — making deliveries, driving passengers or cleaning homes — leading some to prefer the term “platform economy”.

Please note that not all gig economy roles are based around a technology platform and gig economy workers can also work for more traditional companies who might have changed their staffing system.

The article gives the example of delivery drivers for Hermes who work on a piece-by-piece delivery basis.

The gig economy is also found in India in the form of drivers of Uber (or Ola), delivery guys of Swiggy, and plumbers and masseurs you find on services such as UrbanClap.

None of them is an employee of the company you’re contacting for the services but instead, they are “partners”. This means they get paid a commission or earn a share of the bill when they work; and when they don’t, they get nothing.

Much worse, these workers lack protection and fair pay and their income is dependent on the gigs they get.

They don’t get holiday or sick pay because the companies that hire them can claim these are contractors.

Reforms are required for these workers and governments in many countries are starting to recognize this fact.

Then why are highly qualified professionals now joining the gig economy?

The answer to this question is simple – following the sudden loss of full-time employment due to COVID-19 out of work employees needed to find a way to sustain themselves and survive.

In my blog post advocating starting a new business during the pandemic, I’ve mentioned that 57% of those professionals surveyed by Salesforce said being their own boss was the ultimate inspiration as well 25% of respondents brought forward their plans to fly solo.

This scenario is slightly different as it was born out of necessity and then transformed into a way of working for oneself as a freelancer.

At the same time, companies who had laid off staff to survive the total lockdown found the need to get talented and qualified labour back but were not in a position to offer full-time employment.

It looked like a win-win situation.

But when the golden glow of benefits like flexibility in work, efficiency, additional income for the jobless, improvement in productivity and sustaining the bottom lines of the companies that hire gig workers starts to fade, we need to look at some hard facts.

For one, you’ll be seen as an independent contractor and responsible for your own accounting, safety and taxes!

All the issues that apply to the low pay gig workers will apply to you too.

Mitigating the risk and enhancing the rewards of being a gig player

If you really want to make money (and you can) then you need to do your homework first and get all your ducks in a row.

The first thing to check is if there enough demand in the market for your gig.

Even though it will be one piece of work at a time, you have to ensure there are enough people and companies out there who are looking for the skills and experience that you’ll be selling as a gig.

Your mindset is going to be your strongest ally and you need to make the shift from being an employee to a business owner.

It’s equally important to remember the gig economy is all about self-directed freelance work and part-time jobs that let you set your own schedule and work as much (or as little) as you want.

You must be able to handle the pressure of managing the gig without direction as well as all the other hats you’re going to have to wear like marketing, client management and finding work so that your time is utilized.

You’re going to be responsible for negotiating terms like time, hourly rates and scope of work done using your skills.

You might also need to upgrade some skills to ensure your gig work is run like a business.

Secondly, consider the vehicle for your gig – will you be a sole proprietor or launch a proper business with all the paperwork and reporting to the tax authorities?

I’d suggest keeping it simple to start with and consulting a good tax accountant too because the tax structure and deductions are different for salaried people, self-employed and companies.

Don’t spend all your income in one go but put some aside for tax season so that you’re not in a fix later on.

Beware of hidden costs because doing gigs isn’t all income and no expense!

For example, will you be traveling or visiting the client site? Factor that into your quotes. Using the internet to deliver work? Assess how much of that additional expense is related to gig work.

Will you need to take out professional indemnity insurance? Cost of bookkeeper, tax accountant, lawyer to help you with contracts? These are all costs that need to be taken into account.

Which reminds me, make sure you open a separate bank account for your gig business and use it for both income and expenses. Keep it separate from your personal bank account.

You can do your own accounting with different software accounting packages that are available otherwise your tax accountant might be able to refer you to a part time accountant who can create your books for you.

You also need to choose the right gig which takes into account your goals, personality, skills and time. Don’t jump into the first gig that comes along.

Instead, invest time learning more about the gig, the scope of work, negotiate the hourly pay or the gig amount and make sure that you’re not losing out.

Create a proforma contract for the work you do or if the employer has the contract, go through it and discuss all terms and conditions to make sure you don’t end up doing more than you’re supposed to.

When you get it right, you can earn a lot more than you did in your full-time job and the earning potential is unlimited. That’s a great confidence booster too!

The gig may be a temporary thing for you while you wait for the economy to bounce back, but the rules of professionalism still apply.

Getting good reviews and feedback from customers will help with references and the company employing you might just offer you permanent employment once they are in a position to afford you.

The bottom line is, yes, you can make good money in the gig economy provided you do your initial research and choose the right gig.

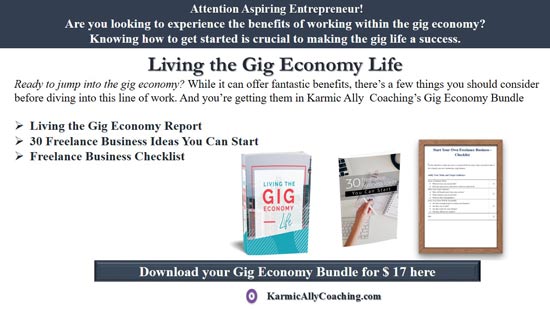

And if you need more guidance, you need to get Karmic Ally Coaching’s Gig Economy Bundle and use it.

[asp_product id=”7436″]

I adhere to the Certified Coaches Alliance Code of Ethics and Standards. A copy is available on request.

I adhere to the Certified Coaches Alliance Code of Ethics and Standards. A copy is available on request.

Let's Talk through the Connect Form:

Let's Talk through the Connect Form: